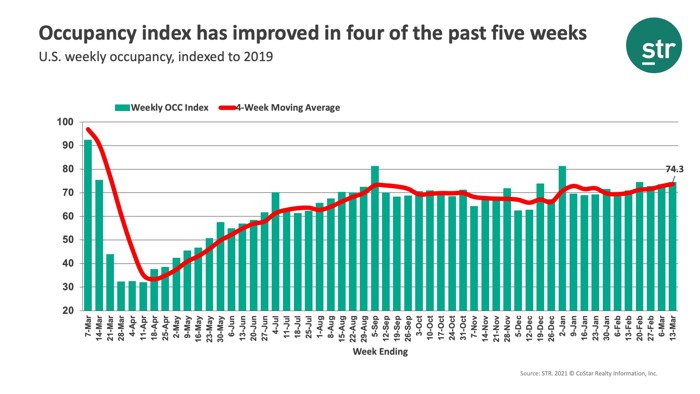

STR Report: U.S. Hotel Recovery Monitor Reaches High Point

March 19, 2021

The U.S. achieved its highest absolute weekly RevPAR ($53.45) since the week ending 14 March 2020. A year-over-year decline of 15.8% was the smallest since the start of the pandemic. However, a lessening of the year-over-year decrease is mostly a function of an easier comparison. When indexed against 2019, RevPAR was 57% of the level achieved during the comparable week in 2019. Similar to the most recent weeks, that RevPAR index remains well in the recession classification.

On a market level, we continued to see a slight increase in the percentage of markets in the recovery category and a reduction among those considered in depression. Of 166 STR-defined markets, 101 saw positive movement in their 28-day RevPAR average when indexed to 2019. San Francisco continued to show the lowest index, whereas the Florida Keys posted the highest. On a hotel-level basis, larger urban hotels are the most likely to be in depression while those that are in small markets have a higher likelihood of reaching peak RevPAR (e.g., above 2019 levels).

More than 19.3 million room nights were sold during the week, the most of the past 52 weeks as demand rose by 1.2 million week over week. Forty-three states saw room demand rise in the week with one-third of the increase coming from two states: Florida and Texas. Florida saw the largest increase of any state, while Texas posted its fourth consecutive weekly gain. Florida also had the highest weekly occupancy of any state followed by Arizona, Texas, Alabama, and Mississippi. These five states all had occupancy above 60% for the week.

Click here to read complete article at STR.