Trade Show Floor SuccessesApril 1, 2014

Exhibition Planning Executives Put New Trends and Tactics Into Practice By Patrick SimmsTrade Show Floor Successes

Exhibition Planning Executives Put New Trends and Tactics Into Practice

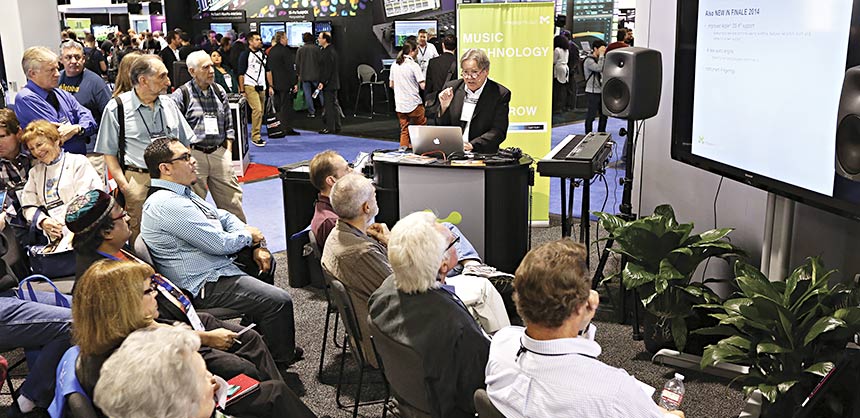

The National Association of Music Merchants has found that relevant music business professionals drive attendance at educational sessions more than outside speakers. The 2014 NAMM Show (shown) attracted more than 96,000 registrants and 1,533 exhibiting companies. Credit: Jesse Grant/Getty Images for NAMM

The current health of the trade show industry can be sized up from a variety of angles, including revenue for host organizations, attendance numbers, attendee and exhibitor spend, and performance of newly launched shows. Fortunately, there seems to be no sign of weakness in any of these metrics.

The International Association of Exhibitions and Events (IAEE) new Public Events Industry Report notes that 95 percent of surveyed organizers of business-to-consumer events indicate better or nearly the same revenue results for 2013. In addition, the report reveals that most newly launched public events “met or exceeded expectations,” and that the auto, F&B, and kids/family/lifestyle/pets sectors “all report seeing signs of recovery moving into 2014.” In terms of attendee and exhibitor spend at trade shows, the numbers are robust, at least according to Pricewaterhouse Coopers’ recent study, commissioned by the Center for Exhibition Industry Research (CEIR). In 2012, attendees accounted for $44.8 billion in direct spend while exhibitors accounted for $24.5 billion across the 11,000 exhibitions that CEIR tracks.

Such statistics demonstrate that trade shows have been a strong economic engine in the U.S., and recent attendance numbers at many major shows ensure that it will continue to be so. Association management and services company SmithBucklin, via its Chicago and Washington, DC offices, serves well over 100 trade show clients, including some of the country’s fastest-growing shows in terms of attendance numbers and net square footage, including ASHE (American Society for Healthcare Engineering) Annual Conference & Technical Exhibition, AONE (American Organization of Nurse Executives) Annual Meeting & Exposition, and America’s Beauty Show. The success of the latter show is particularly reassuring, since the beauty products segment is very sensitive to economic ups and downs.

“Attendance across the board has been up, so that’s been great,” says Carol McGury, SmithBucklin’s executive vice president, event and education services. And thus far this year, “we’ve seen growth in some of the smaller shows of 80–100 exhibitors. In addition, we have new clients in all three of our industry practices: business trade, health care and scientific, and technology. They include AOCA (Automotive Oil Change Association) and HBMA (Healthcare Billing and Management Association).”

Strengthening Economy Builds Exhibitor Strength

Many factors can influence show growth and performance, but the primary one is the vitality of the target industry. For example, the 37th National Association of Music Merchants (NAMM) Show, held January 23–26 in Anaheim, California, saw 1,533 exhibiting companies representing 5,010 brands, the second-highest number ever, as well as a 2 percent increase in buyers over 2013. “In part, the show’s growth is a reflection of steady post-recession growth in the music product industry,” says Cindy Sample, NAMM’s director of trade show operations. “The NAMM Show is a platform for the industry, and the growth of the show reflects what is happening in the global music product marketplace. There were many new exhibiting brands entrepreneurs who have enough restored faith in the economy to launch their dreams at the show. The music product industry is also seeing growth in buyers and exhibitors from the pro audio and music technology segments.” The NAMM Show, the largest trade show held at the Anaheim Convention Center, drew more than 96,000 registrants, including music products industry retailers, buyers, manufacturers, sales representatives, musicians and media from around the world.

A different corner of the entertainment industry, represented by the IAAPA (International Association of Amusement Parks and Attractions), is also doing well, resulting in a 10-year high in the number of exhibitors and registrants at the 2013 Attractions Expo. A big reason is “the overall health of the global attractions industry, which is in the midst of tremendous growth, especially in Asia,” comments Ryan Strowger, V.P., exhibitions, conferences and sales. “As new markets emerge, the need for new, innovative product increases, so one might anticipate that this would therefore be reflected in the overall size of the Expo.”

Educational Content and Vertical Markets

New vertical markets represented within a show often go hand in hand with new buyers, and the host association does well to ensure they are fully engaged. That means more than having exhibitors catering to their product interests; in addition, their educational interests should be reflected in the program content. Typically, associations rely on member committees to develop content, and trust that the resulting program will “address the latest trends, hot topics and best practices,” says Strowger, noting that the IAAPA’s 30-member committees evaluate presentation proposals for the Attractions Expo’s education conference. And while trends and niche interests are important, those topics with the widest appeal must remain at the core.

NAMM’s Sample adds, “Certain topics, such as promotions, social media, lesson programs, finance and inventory management, appeal to an enormous segment of our attendance. We’re able to attract an extremely broad group of attendees by focusing on these topics.”

The general trend in recent years has been to channel that key content into fewer sessions. “The older, stodgier thinking about events is that we’ve got to have 500 different sessions to have something for everybody,” McGury says, referring to the mindset of five to 10 years ago. “Now we’re seeing more quality vs. quantity. It’s about figuring out what demographic you’re going after, and making more educated decisions about the balance of sessions and who the presenters will be.” For example, NAMM has found that relevant music business professionals drive attendance at educational sessions more than outside speakers.

Similarly, the exhibition experience should be streamlined with demographics in mind, says McGury: “You really need to understand your audience to know whether you have the right exhibitors on the floor, because it’s not a strong strategy to sell somebody to be on your floor if they don’t have a real fit with your audience.” An excessive number of education sessions also can frustrate attendees who are faced with myriad choices, which is why more organizations are looking at offering content on an ongoing basis through virtual programs, as opposed to compressing too much into the live event.

Customer-Centric Focus

In these ways, trade shows are becoming more customer-centric, a priority that is reflected in more than just educational content delivery. “What can we do to make this show better and more effective for (attendees with specific interests)?” asks Jim Pittas, vice president, trade shows with PMMI — The Association for Packaging and Processing Technologies, which runs Pack Expo. “We’ve spent a lot of money, time and effort on creating products and services just for those attendees. When you ask our attendees what they do for a living, they don’t say, ‘I work in the packaging industry,’ they say beverage or baking or pharma. So we have all these vertical markets that make up Pack Expo.”

As an example of these targeted products and services, Pittas cites “lounges and learning centers on the floor that we have co-opted with other trade associations, such as the Candy Bar, which is supported by the National Confectioners Association. We make that the meeting place for attendees in the confectionary industry.” The lounges include reception areas with F&B service. Pittas explains, “We found through our research that attendees, as much as they want to talk to exhibitors and see new technologies, they want to talk to each other as well. So we create these networking lounges on the floor that are branded by the vertical industry and endorsed by the end-user association. It’s been very successful.”

Interactive Product Theaters and Learning Lounges

Within the last three years or so, both networking and education have been increasingly supported by specialized venues on the exhibit floor. Product theaters, led by exhibitors, have been utilized for well over five years, but McGury stresses that the approach to these presentations has become much more interactive. In the past, the theaters were simply used to give product updates, whereas now presenters “hit the main concepts and then engage in a conversation with the customers, who may discuss how they (applied) the solution in a way that worked for their company. So that is the evolution of these theaters and learning lounges in the last few years: People are setting aside physical space to engage in dialogues,” she explains. “Theaters and learning centers also are physically set up differently so that it doesn’t feel like you’re walking into a booth; they may be set off with hard walls and have chairs circling around the presenter to create more of an interactive environment.” In fact, the capacity to facilitate dialogue, not merely lecture, is a desirable quality in presenters these days, McGury adds.

The learning lounges on the show floor also can serve double duty: Not only can exhibitors take the stage here, but speakers from the educational sessions also can continue their presentations at the venues. For example, they might not have had time for a Q&A at the end of their talk, and that can be conducted in a learning lounge. McGury sees Q&As increasingly extending into the virtual space, with social media such as Twitter being effectively used as audience response systems. “Because everyone is more comfortable with how to use social media, I think you’re going to see a prevalence of (social media-enabled Q&As) in the future.”

Event Timing and Show Floor Strategy

Show floor theaters and lounges also afford the exhibition more drawing power. For instance, the IAAPA Theater “allows for marquee events to take place in the exhibit hall, ensuring attendees can remain on the floor longer,” Strowger notes. However, the timing of these special events — whether product theaters, receptions, gaming and so on — must respect the need for regular booth traffic. Staging several events concurrently, for example, might divert too many buyers from the exhibits.

The same principle applies to the timing of the education sessions. “The education sessions are strategically timed so they do not compete with peak floor hours, allowing attendees to maximize their time talking to exhibitors,” Strowger says.

The IAAPA, like many associations, takes a multipronged approach to maximizing exhibit floor traffic: “There is a restaurant on the show floor so attendees do not have to leave the floor to get something to eat, and we recently added benches throughout the floor so attendees can rest without leaving the floor,” she says. “In addition, the pavilions for specific product categories and major cross aisles allow attendees to more easily navigate the floor.” Similarly, the NAMM Show floor is organized by neighborhoods representing segments of the music product marketplace. “These neighborhoods assist buyer and attendee navigation,” says Sample. “We make sure it’s easy to find a company or a product. It also can be effective to create feature areas that will draw buyers and attendees through new exhibit spaces so they become familiar with those areas.”

“We make sure it’s easy to find a company or a product. It also can be effective to create feature areas that will draw buyers and attendees through new exhibit spaces so they become familiar with those areas.” — Cindy Sample

Virtual Realities

Online exhibitor directories are commonly used to help attendees plan their booth visitation itinerary, but the interactive “virtual trade show” has been much less common, and some feel its value proposition is questionable. “We have looked at a couple different models for virtual trade shows, and we’re not afraid to do it, say to risk cannibalizing our live attendance,” Pittas says. “But the thing that’s always struck me about those who have done a virtual trade show is that they’re not doing it now. Nobody has really come up with a model that has gotten any kind of traction.”

The viability of a virtual trade show likely depends on the audience, however. For example, in the technology sphere, attendees may be more open to interacting with exhibitors solely through a virtual medium. “I think there have been some instances where (show owners) have said, ‘Hey, that’s cool technology. Why don’t we do a virtual trade show?’ without understanding the demographics of their audience and whether there’s a need,” McGury says. As an example of a successful virtual trade show, she cites one that SmithBucklin orchestrated for VMUG, a VMware user group, with about 8,000 attendees. “But this was a group that could afford the technology,” she adds.

While not keen on virtual trade shows, PMMI is investing in developing a digital strategy over the next few years to support its lineup of six shows: the venerable Pack Expo International, held in Chicago; Pack Expo Las Vegas; Pharma Expo, a joint venture with ISPE; Expo Pack Mexico and Expo Pack Guadalajara; and the new Pack Expo East, which will be launched in Philadelphia next year.

Offshoot Shows

PMMI is no stranger to launching offshoot shows: Pack Expo Las Vegas began as a West Coast version of the Chicago show, Pittas notes, and the Guadalajara show is an offshoot of the Mexico City show. Researching what attendees want in terms of regional show offerings is critical, so when it came to launching Pack Expo Las Vegas, the “big push” was the fact that “our members were really frustrated with the offerings out West compared to what they were getting from us in Chicago,” Pittas explains. Similarly, member surveys narrowed down the site choices for the new Pack Expo East to Philadelphia, and informed the decision that the show should be a standard Pack Expo instead of a specialized pharma show.

As the trade show industry continues its upward trend, some associations may judge that the market can bear additional regional versions of their shows. Although there is the promise of new revenue, there is also the possibility that the new shows may siphon away attendees from existing shows, especially in regions that are relatively close. For example, at the time Pack Expo Las Vegas was being considered, “I can guarantee you that the conversation was, are we going to cannibalize Chicago, not just in attendance but also in exhibit space?” Pittas says. “What we saw happen was that exhibitors in Chicago that had 4,000–5,000 sf started off in Las Vegas with maybe 500–1,000 sf. And now they’ve started to even out more, with maybe 3,000 sf in Chicago and 2,000 sf in Las Vegas. And the extra benefit that we got was that Pack Expo Las Vegas opened up more space at the Chicago show and more exhibitors came into Chicago, since we had wait lists for that show. We’re hoping the same thing happens with Pack Expo East, taking a little pressure off Chicago.”

Thus, the possibility of an offshoot show’s siphoning exhibitors or exhibit space from an existing show is not always a bad thing, as it can ease logistics at the existing show and free up space for new exhibitors. There also can be a promotional benefit: “The success of IAAPA’s two other trade shows, Euro Attractions Show and Asian Attractions Expo, has exposed companies to IAAPA’s buying market, and as a result we have seen an increase in overall exhibition size at IAAPA Attractions Expo, and vice versa,” says Strowger.

As the economy continues to trend upward, conference executives like Ryan Strowger, JimPittas, Carol McGury and Cindy Sample who stay on top of the trends and continually implement new strategies will keep their show numbers going in the same positive direction. AC&F