Trade Shows And Exhibitions In The Post-COVID-19 Era: CEIR Research Results

August 10, 2020

The Center for Exhibition Industry Research has released the results of its latest poll tracking the impact COVID-19 is having on the U.S. business-to-business exhibition industry.

“The persistence of COVID-19 and the uncertainty of whether events can take place in their scheduled destinations are forcing an increasing number of U.S. B2B exhibition organizers to either postpone their events to late 2020/early 2021 or cancel them entirely,” noted CEIR CEO Cathy Breden, CMP, CAE, CEM. “This trend is devastating to an industry that contributed over $101 billion to the U.S. GDP last year. CEIR provides valuable impact information to both Exhibitions Mean Business and the Go LIVE Together initiatives for use in advocating for the industry to Congress.”

CEIR Vice President of Research Nancy Drapeau, PRC added, “The top two reasons speak to the chaos of the current situation, as 74% of those forced to cancel say the lack of clarity in knowing whether large group meetings will be allowed to take place at the scheduled time due to state and local lockdown orders prompted them to this decision. IMTS scheduled to take place in Chicago is a prime example. In addition, many organizers (69%) attribute the persistence of corporate ‘no travel’ policies and the impact they might have on participation levels as a reason for foregoing a 2020 in-person event.”

Shift to Digital is Growing While the Industry is Paused

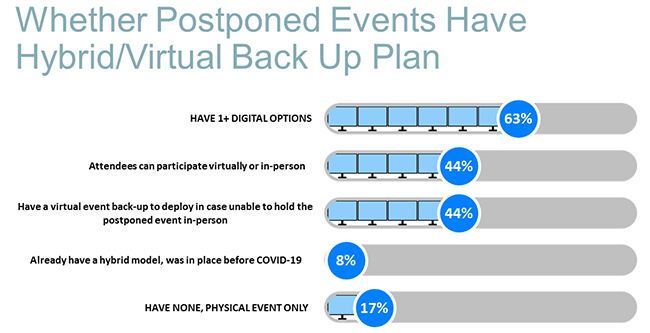

Exhibition organizers are doing all that they can to defend the health of their organizations and serve the needs of their communities in the midst of this crisis. A new question CEIR’s survey posed to organizers that have postponed an event is whether they have added a hybrid or virtual component to these events. Responses reflect that 63% have, with 44% giving attendees the option to attend in-person or virtually and the same percentage (44%) having a virtual event backup plan in the event they are forced to cancel at the last minute. Among organizers forced to cancel 2020 events, the shift to digital has grown to 81%, compared to 69% in the April survey. What is most notable is the increase in full virtual trade shows, 41% compared to 15% in the previous survey.

The survey also profiles data on gross revenues retained and gained from efforts to move participants of canceled events to digital options or other face-to-face (F2F) events offered by an organizer. It also explores the revenue outlook for virtual events, whether there was a fee to attend, and whether these organizers sought revenues via sponsorship and virtual booth sales. Lastly, it quantifies which tactics and strategies executives plan to undertake moving forward, in a post-COVID world.